What Is The Difference Between Contract For Deed And Rent To Own?

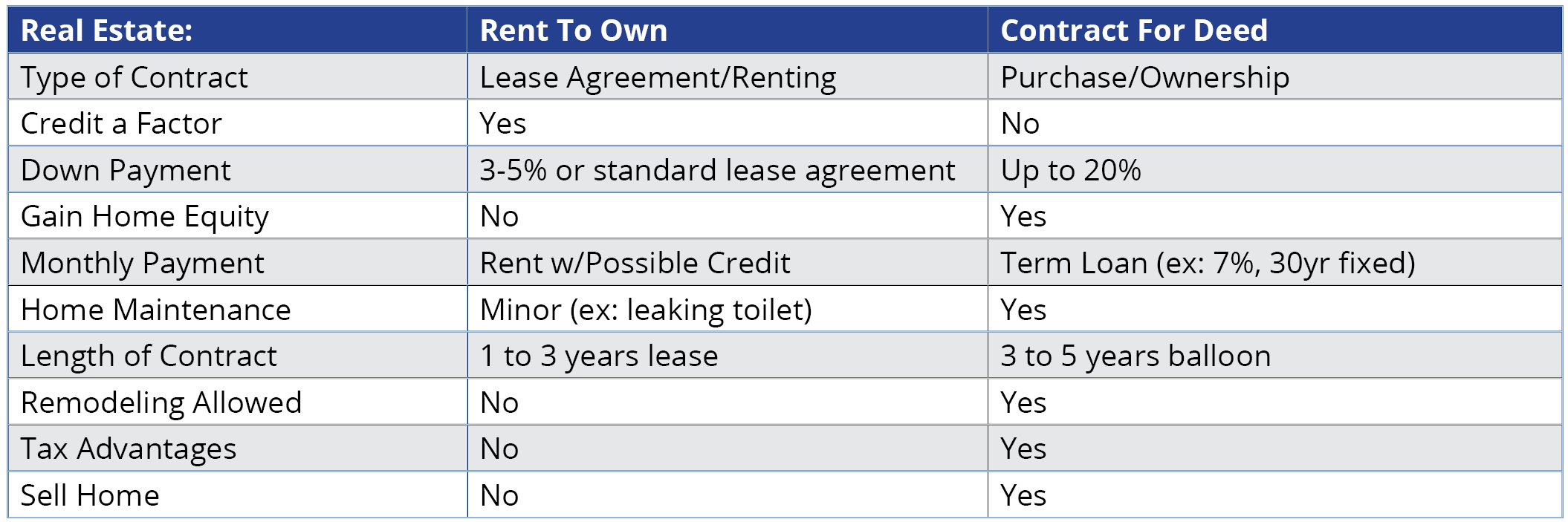

These two terms are often used interchangeably, creating confusion for people weighing their options for finding a home. There are critical differences between contract for deed and rent to own.

Is Rent To Own The Same As Contract For Deed?

No.

In fact, these two types of real estate contracts are polar opposites of each other.

A rent to own is still a lease agreement with a landlord/tenant relationship, while contract for deed allows you to purchase the property and enjoy all the benefits of home ownership.

In fact, contract for deed is the only alternative home financing option available to buyers who still want to own their home. This brings many advantages over a rent to own.

Contract For Deed vs. Rent To Own Minnesota Home Financing

Rent To Own

Rent to own – aka lease option, lease to own, option to purchase, rent with option to buy, etc. – is renting the home with the intent to purchase it within a predetermined timeline (usually one to three years). Credit scores are crucial in these lease agreements as the landlord or property management company will pull credit as part of the application process.

In a rent to own, the landlord and tenant agree up front on a purchase price when signing the agreement. For example, a tenant and landlord could agree on a $200,000 purchase price. At any time during the lease agreement the tenant can purchase the home at this pre-determined price. This would typically occur once they are able to achieve financing from a bank.

One benefit of lease to own is that a tenant can lock in today’s home prices while they fix their credit to obtain financing. Another benefit to the renter/potential buyer is that rent to own reserves the house for them; the landlord will not be able to sell to another buyer during their lease.

Is There A Down Payment In Rent To Own?

Yes.

Instead of taking a security deposit and one month’s rent seen in a typical lease; a landlord may choose to ask for a non-refundable “option down payment” ranging from 3-5% of the purchase price. This is to give the landlord security since the intent is to purchase the home (and the main reason landlords agree to do a rent to own versus a normal lease). If the tenant purchases the home this option down payment will go towards their financing, otherwise the landlord will keep it when the tenant moves out.

In other words, an option down payment is non-refundable if the tenant is not able to obtain bank financing within the agreed upon timeframe.

What Is A Monthly Rent Credit?

A monthly rent credit is a percentage of the tenant’s rent being credited towards their down payment and eventual purchase. Think forced savings plan.

The catch is that this credit is almost always based on above-market rent prices. For example, if the normal market rent for the house is $1,600, the landlord will raise the rent to $1,750 to account for a rent credit of $150. In other words, there is virtually no benefit to the renter. It should also be noted the landlord will keep the rent credit during the lease agreement, and if the tenant fails to exercise their option to purchase the home landlord gets to keep everything.

Who Is Responsible For Home Maintenance In Rent To Own?

Tenants will likely be expected to take on minor home maintenance responsibilities during their lease along with outside yard work. However, major structural repairs such as a new roof should be covered by the landlord’s existing homeowners’ insurance policy. Like any contract, it’s crucial to read the fine print so you know what your rights and responsibilities are.

Who Owns The Property In Contract For Deed?

There are numerous differences between rent to own and contract for deed; ownership of the property is the most crucial difference to consider. Unlike rent to own where it is a landlord/tenant relationship contract for deed buyers: own the property, pay property taxes, carry homeowners’ insurance, and have full responsibility for property maintenance.

Is There A Down Payment?

Yes.

The down payment is a critical component of contract for deed. Down payments range between 10-20% of the purchase price.

Does Credit Matter?

No.

Bad credit or no credit is not a problem. Our no credit check loan program is the number one reason people pursue contract for deed versus rent to own.

Is There A Monthly Payment On Contract For Deed?

Yes.

Like a bank mortgage or car loan, a contract for deed will have a interest rate with a set term (ex: 30yr or 15yr) where monthly principal and interest payments are made. This reduces the loan balance over time, and is an attractive alternative to throwing money away on a rent to own.

Is There A Balloon Payment?

Yes.

It is common with contract for deed to have a balloon payment, which provides a way for the owner/seller to set a date on when they want the buyer to refinance into a bank mortgage or sell the home. It is generally a longer timeframe (up to 5 years) versus rent to own where the lease is typically 1-3 years.

Can You Make Home Improvements?

Yes.

Not only can you make home improvements with contract for deed, but you will also reap the financial rewards of any increase in value your sweat equity brings. This differs from rent to own, where the tenant is not allowed to make material improvements to the property before purchasing it.

Can You Sell The Property For A Profit?

Yes.

If a buyer is unable to refinance into a bank mortgage during the contract for deed, they always have the option of selling the property. At minimum they will recoup their down payment, along with all their monthly payments that went towards the loan principal.

As an added bonus, with Minnesota home values continuing to rise there also will most likely be a profit via home equity appreciation.

This becomes a major advantage over rent to own where the tenant has virtually no ability to recoup their option down payment, or rental credit, if they are unable to purchase the home. Even worse, they could face eviction from their landlord.

Are There Tax Advantages To Contract For Deed?

Yes.

Just like a bank mortgage, the buyer can deduct interest paid on the loan as well as property taxes. This is a major advantage over rent to own.

Ready To Take The First Step?

You have come to the right place if contract for deed sounds right for you. Call 651-307-7663 or fill out our contact form to get in touch with a proven MN contract for deed investor at CBlock Investments.

Why Contract For Deed?

It is the #1 alternative home financing solution since credit is not a qualifying factor for loan approval.

GET IN TOUCH

We would love to hear from you! Please fill out the form below completely, and then provide a brief message so that we can expedite the process of handling your inquiry. Talk soon!

No Credit Check

Bad or no credit is OK! This contract for deed financing program is strictly income & cash down payment based.

Fast & Easy Application

Get an immediate response on loan approval without all the hoops a bank makes you jump through.

Get The Home You Want

Don't let that perfect house slip by because the bank turned you down for financing. All of Minnesota qualifies. Realtors always welcomed.

Follow

Want to learn even more about Contract for Deed? Follow, to stay connected on new stories and updates in the industry.

©2021 CBlock Investments, LLC All Rights Reserved.

Design by Dravallo, A Creative Agency